Per Capita Tax Form Exemptions

| Exemption from Grove City Per Capita Tax (PDF) |

| Exemption from Mercer County Per Capita Tax (PDF) |

About the Per Capita Tax

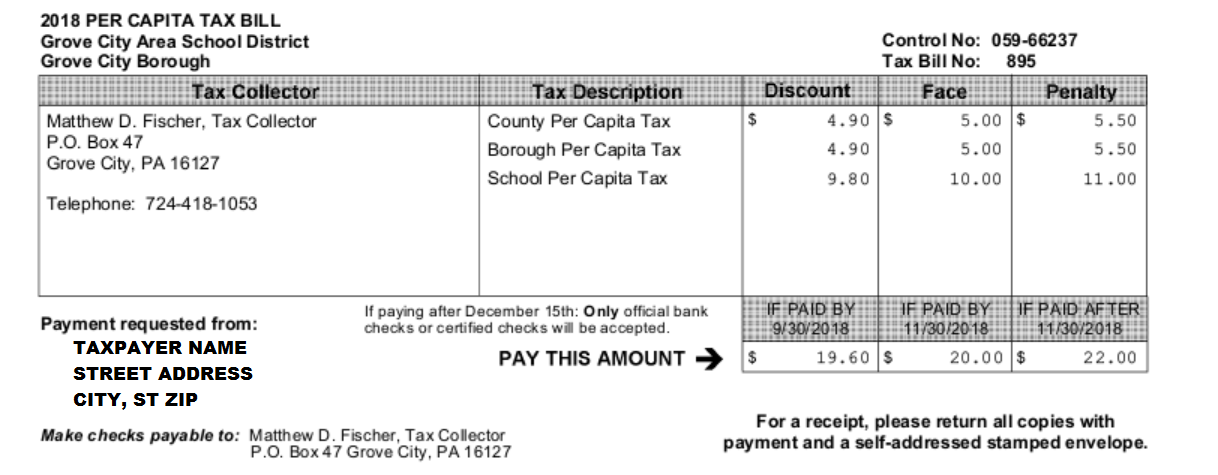

A Per Capita Tax is a flat rate tax levied upon each individual, eighteen years of age or older, residing within the taxing district. The tax has no connection with employment, income, voting rights, or any other factor except residence within the community. Per capita tax for Grove City Borough is five dollars per individual, per capita tax for Mercer County is five dollars per individual, while per capita tax for Grove City School District is ten dollars per individual. A combined per capita tax is billed on August 1 of each year.

Per Capita Payment Schedule

- $19.60 if paid in August or September

- $20.00 if paid in October or November

- $22.00 if paid after November 30th

- *No payments will be accepted after 6:00pm on December 31 of the tax year.

Per Capita Exemptions (must be filed annually, forms at top of page):

- Borough/School District: Your income from all sources is less than $5,000 per year.

- County: Your income from all sources is less than $10,000 per year.

Per Capita Tax FAQ

- What is the Per Capita Tax?

- A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. It is not dependent upon employment.

- I rent, do I have to pay the Per Capita Tax?

- Whether you rent or own, if you reside within a taxing district, you are liable to pay this tax to the district.

- I moved and this bill was forwarded to me, do I have to pay the per capita tax?

- It depends on the date you moved. You are subject to the $5 Mercer County Per Capita Tax if you lived in Mercer County on or after March 1. You are subject to the $5 Grove City Borough Per Capita Tax if you lived in Grove City Borough on or after March 1. You are subject to the $10 School Per Capita Tax if you lived in the Grove City Area School District on or after July 1.

- I paid this tax to another tax collector, do I have to pay it twice?

- Please provide us proof and we will credit the per capita tax bill for the amount of tax paid to the other tax collector/tax district.

- Is there an income exemption?

- Yes, you must be unmarried and receive less than $5,000 from all sources per calendar year to be fully exempted from the tax for the year. Exemptions forms can be requested or downloaded at www.gctaxoffice.com. Married couples takes both incomes into consideration. Please see exemption forms for more details.

- I never received a Per Capita Tax bill in the mail, can you take off the penalty?

- Taxpayers are charged with the tax whether you receive the notice or not. Penalties cannot be waived. If you do not receive a tax bill in the mail it is your responsibility to contact the tax collector and arrange payment.

- I think my employer withholds this tax.

- No they do not. The per capita tax is not a payroll deduction.

- I think my escrow company withholds this tax as part of my mortgage payment.

- No they do not. You are required to pay the per capita tax out of non-escrow funds. Per capita tax is not real estate tax and is not escrowed and it is not paid by the mortgage company.

- How can I get a receipt for payment?

- Please include a self-addressed stamped envelope with your payment.

- The tax bill has the wrong information on it, or my name is misspelled etc?

- Please contact us so that we can make the corrections in our database, or when making payment please write the correct information on the front of the bill.

- I am a college student and do not live in Grove City.

- According to the PA Dept of Revenue: Generally, a college student has the same domicile as his or her parents or legal custodian. Becoming a legal adult at age 18 does not by itself separate a child from the parent's or legal custodian's domicile. The child merely acquires the power to establish a separate or new domicile. College dormitories, fraternity and sorority houses, and off-campus rentals by students enrolled in colleges or universities do not qualify as permanent abodes.